Travel + Leisure Co. Reports Second Quarter 2023 Results

Travel + Leisure Co. (NYSE:TNL), the world’s leading membership and leisure travel company, today reported second quarter 2023 financial results for the three months ended June 30, 2023. Highlights and outlook include:

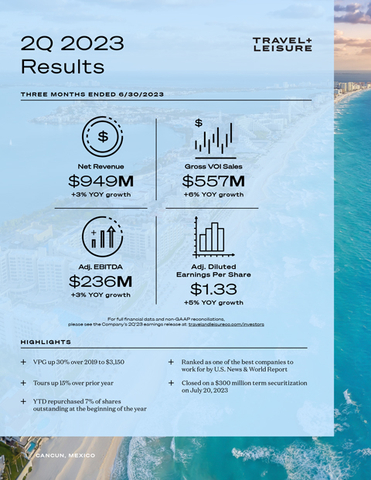

- Net income of $94 million, $1.18 diluted earnings per share from continuing operations, on net revenue of $949 million

- Adjusted EBITDA of $236 million and adjusted diluted earnings per share of $1.33 (1)

- Reaffirms full year adjusted EBITDA guidance of $925 million to $945 million and expects third quarter adjusted EBITDA from $245 million to $260 million

- Repurchased $202 million of common stock in the first half of 2023, including $100 million in the second quarter

- Management will recommend a third quarter dividend of $0.45 per share for approval by the Board of Directors

- Executed $300 million term securitization on July 20, 2023

“The company’s second quarter results met our expectations, while sales volume per guest was at the high end of our guidance,” said Michael D. Brown, president and CEO of Travel + Leisure Co. “In the second quarter, we returned $135 million to shareholders, continuing our strategy of delivering strong capital returns to shareholders. We have consistently bought back shares this year, reducing our total share count by 7 percent since the beginning of 2023.”

(1) This press release includes Adjusted EBITDA, Adjusted diluted EPS, Adjusted free cash flow, Gross VOI sales and Adjusted net income, which are measures that are not calculated in accordance with Generally Accepted Accounting Principles in the U.S. (“GAAP”). See “Presentation of Financial Information” and the tables for the definitions and reconciliations of these non-GAAP measures. Forward-looking non-GAAP measures are presented in this press release only on a non-GAAP basis because not all of the information necessary for a quantitative reconciliation is available without unreasonable effort..

Business Segment Results

Vacation Ownership

| $ in millions | Q2 2023 | Q2 2022 | % change |

| Revenue | $768 | $735 | 4% |

| Adjusted EBITDA | $187 | $187 | —% |

Vacation Ownership revenue increased 4% to $768 million in the second quarter of 2023 compared to the same period in the prior year. Net vacation ownership (VOI) sales were $401 million in the second quarter compared to $400 million in the prior year period, and Gross VOI sales were $557 million compared to $527 million in the prior year. Gross VOI sales were driven by tours of 170,000 during the quarter compared to 148,000 in the same period last year, partially offset by a 10% decrease in VPG. Net VOI sales were impacted by the normalization of the provision, and the impact of excluding fee-for-service sales.

Second quarter adjusted EBITDA was flat compared to the prior year period at $187 million, with the revenue growth offset by an increase in marketing costs in support of increased tour flow and new owner mix as well as higher consumer finance interest expense.

Travel and Membership

| $ in millions | Q2 2023 | Q2 2022 | % change |

| Revenue | $179 | $188 | (5)% |

| Adjusted EBITDA | $62 | $64 | (3)% |

Travel and Membership revenue decreased 5% to $179 million in the second quarter of 2023 compared to the same period in the prior year. This was driven by an 8% decrease in transactions offset by revenue per transaction growth of 1%. The transaction decline was driven by lower RCI member propensity and a decrease in Travel Club transactions.

Second quarter Adjusted EBITDA was $62 million compared to $64 million in the prior year due to lower transaction revenue, partially offset by lower cost of sales and lower marketing costs.

Balance Sheet and Liquidity

Net Debt —As of June 30, 2023, the Company’s leverage ratio for covenant purposes was 3.7x. The Company had $3.7 billion of corporate debt outstanding as of June 30, 2023, which excluded $1.9 billion of non-recourse debt related to its securitized notes receivables portfolio. Additionally, the Company had cash and cash equivalents of $214 million. At the end of the second quarter, the Company had $818 million of liquidity in cash and cash equivalents and revolving credit facility availability.

Timeshare Receivables Financing — Subsequent to the end of the second quarter, the Company closed on a $300 million term securitization transaction with a weighted average coupon of 6.7% and a 91.7% advance rate.

Cash Flow—For the six months ended June 30, 2023, net cash provided by operating activities was $110 million compared to $230 million in the prior year period. Adjusted free cash flow was $11 million for the six months ended June 30, 2023 compared to $121 million in the same period of 2022 due to higher year-over-year originations in our loan portfolio, as well as other working capital items and increased interest payments on our corporate debt.

Share Repurchases — During the second quarter of 2023, the Company repurchased 2.6 million shares of common stock for $100 million at a weighted average price of $38.54 per share. As of June 30, 2023, the Company had $275 million remaining in its share repurchase authorization.

Dividend—The Company paid $35 million ($0.45 per share) in cash dividends on June 30, 2023 to shareholders of record as of June 15, 2023. Management will recommend a third quarter dividend of$0.45per share for approval by the Company’s Board of Directors in August 2023.

Other Items

Taxes — Tax regulation changes enacted at the state level resulted in a discrete impact on the tax provision rate which lowered Adjusted EPS by approximately $0.03 for the quarter. However, we do not expect the changes to have a significant impact on the full year tax rate.

Outlook

The Company is providing guidance regarding expectations for the 2023 full year:

- Adjusted EBITDA of $925 million to $945 million

- Gross VOI sales of $2.1 billion to $2.2 billion

- VPG of approximately $3,050 to $3,150

The Company is providing guidance regarding expectations for the third quarter 2023:

- Adjusted EBITDA of $245 million to $260 million

- Gross VOI sales of $580 million to $600 million

- VPG of approximately $3,000 to $3,100

- Travel and Membership Adjusted EBITDA of $60 million to $65 million

- Adjusted EPS of approximately $1.43 to $1.55 assuming no additional share repurchases

Following are sensitivities to third quarter Adjusted EBITDA guidance. The impact of a 100 bps change in our key Vacation Ownership drivers would be expected to be as follows:

- Tours: approximately $1.5 million change in Adjusted EBITDA

- VPG: approximately $2.5 million change in Adjusted EBITDA

Sensitivities to Adjusted EBITDA are based on average system wide trends. Operating circumstances, including but not limited to brand mix, product mix, geographical concentration or market segment variability, may cause the impact to differ materially.

Related: Travel + Leisure Co. Ranked A Best Company to Work For By U.S. News & World Report

This guidance is presented only on a non-GAAP basis because not all of the information necessary for a quantitative reconciliation of forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measure is available without unreasonable effort, primarily due to uncertainties relating to the occurrence or amount of these adjustments that may arise in the future. Where one or more of the currently unavailable items is applicable, some items could be material, individually or in the aggregate, to GAAP reported results.

Conference Call Information

Travel + Leisure Co. will hold a conference call with investors to discuss the Company’s results and outlook today at 8:30 a.m. ET. Participants may listen to a simultaneous webcast of the conference call, which may be accessed through the Company’s website at travelandleisureco.com/investors, or by dialing 877-733-4794 ten minutes before the scheduled start time. For those unable to listen to the live broadcast, an archive of the webcast will be available on the Company’s website for 90 days beginning at 12:00 p.m. ET today. Additionally, a telephone replay will be available for seven days beginning at 12:00 p.m. ET today at 877-660-6853.

Presentation of Financial Information

Financial information discussed in this press release includes non-GAAP measures such as Adjusted EBITDA, Adjusted diluted EPS, Adjusted free cash flow, gross VOI sales and Adjusted net income, which include or exclude certain items, as well as non-GAAP guidance. The Company utilizes non-GAAP measures, defined in Table 5, on a regular basis to assess performance of its reportable segments and allocate resources. These non-GAAP measures differ from reported GAAP results and are intended to illustrate what management believes are relevant period-over-period comparisons and are helpful to investors when considered with GAAP measures as an additional tool for further understanding and assessing the Company’s ongoing operating performance by adjusting for items which in our view do not necessarily reflect ongoing performance. Management also internally uses these measures to assess our operating performance, both absolutely and in comparison to other companies, and in evaluating or making selected compensation decisions. Exclusion of items in the Company’s non-GAAP presentation should not be considered an inference that these items are unusual, infrequent or non-recurring. Full reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures for the reported periods appear in the financial tables section of the press release.

The Company may use its website as a means of disclosing information concerning its operations, results and prospects, including information which may constitute material nonpublic information, and for complying with its disclosure obligations under SEC Regulation FD. Disclosure of such information will be included on the Company’s website in the Investor Relations section at travelandleisureco.com/investors. Accordingly, investors should monitor that Investor Relations section of the Company website, in addition to accessing its press releases, its submissions and filings with the SEC, and its publicly noticed conference calls and webcasts.

About Travel + Leisure Co.

As the world’s leading membership and leisure travel company, Travel + Leisure Co. (NYSE:TNL) transformed the way families vacation with the introduction of the most dynamic points-based vacation ownership program at Club Wyndham, and the first vacation exchange network, RCI. The company delivers more than six million vacations each year at 245+ timeshare resorts worldwide, through tailored travel and membership products, and via Travel + Leisure GO – the signature subscription travel club inspired by the pages of Travel + Leisure magazine. With hospitality and responsible tourism at the heart of all we do, our 19,500+ dedicated associates bring out the best in people and places around the globe. We put the world on vacation. Learn more at travelandleisureco.com.