Property Valuation and Appraisal Considerations for Insurance Renewals

Once upon a time, property insurance renewals were an annual formality. They often consisted of a brief conversation, a review of a property listing, and a moderate 2%-4% increase in valuation to account for inflation. These valuations and renewals have instead become increasingly consequential today. A property insurance appraisal of building and equipment assets performed by an experienced, independent third party can be key in this preparation.

Total Insurable Value – TIV

It is important to understand how insurance renewal values of assets such as buildings and equipment are calculated. With rare exceptions, they are either the product of a recent appraisal or the application of an inflationary trend to a previously appraised value. Typically, a commercial property insurance policy is written using a concept known as total insurable value or TIV. This is the maximum value to cover the entire covered property in the case of a total loss. While there are caveats (e.g., business interruption is not discussed in the article), TIV can be considered the cost to replace an entire hotel or resort. The property rate is then applied to the TIV to calculate the premium.

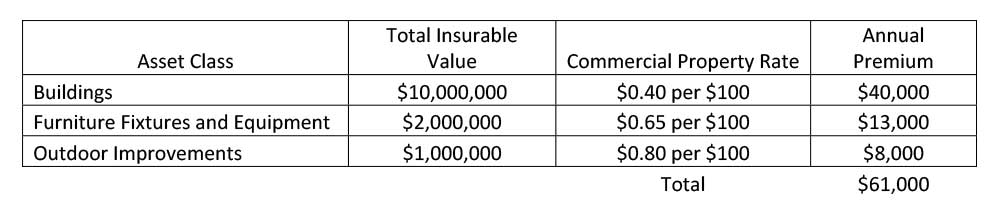

A simplified example would be a resort property valued at $10 million with a commercial property rate of $0.04 per $100 would pay $40,000. Different types or classifications of property have different rates. Outdoor improvements, equipment, and furnishings — considered more susceptible to loss than brick and mortar — usually have higher rates.

Consider the $10 million dollar resort that has $2 million in furniture fixtures and equipment (often referred to as FF&E or simply contents) and $1 million in outdoor improvements (tiki bars, cabanas, etc.) The premium rate calculation could look like chart.

Definition of Value

An insurance policy will lay out exactly what the value of the property being insured includes in case of a loss in the definition of value. Three of the most common definitions of value include:

Replacement Cost New (RCN):

RCN refers to the cost that would be incurred if the asset were to be replaced with a new one today. It takes into account the utility and composition of the asset. For instance, a resort would need to be replaced with the same square footage, room capacity, and construction components.

Related: Are You Covered? Strategies for Insurance Renewal

Actual Cash Value (ACV)

To calculate ACV, you start with the replacement cost above and factor in depreciation based on the age and condition of the property. A 15-year-old resort with a replacement cost of $10 million replacement cost new might have an actual cash value closer to $6 to $7 million. Renovations and upgrades performed in those 15 years would change this calculation and should be considered closely. While policies with an ACV definition of value have less expensive premium totals, they will not cover the full cost to replace an asset in the case of a total loss.

Reproduction Cost

The property’s uniqueness should be considered when reviewing the definition of value. Some resort facilities feature one of kind or historic aspects. Unlike the other definitions, reproduction cost considers the estimated expense to restore an exact replica of the asset. This type of architectural restoration requires artisan craftsmanship and comes at a premium. While not applicable to most asset types, reproduction costs should be considered in certain circumstances where the “irreplaceable” needs to be insured. These definitions represent the bulk of policies but there are always additional fine-print specifics in coverage. It is imperative that the definitions are reviewed and considered during the renewal process. Does the definition meet coverage needs and expectations? Is the property value based on the definition?

Uncertainty drives premium. Try to remove it whenever possible.

The basic task of property insurers, reinsurers, and underwriters is to weigh the risk to a covered property to the premium derived from it. One factor in this risk calculation has been modeling historical data to predict the likelihood of a catastrophic event such as a natural disaster. Climate change has broken historic models, making predictions for future events bleak.

Related: Accounting for Disasters and Insurance Proceeds: Is Your resort Prepared?

Hurricane Ian (Sept. 2022) is estimated to have caused property losses of $60 billion for a single event and is the latest in line with large-scale natural catastrophes and $100 billion average annual losses over the past five years. While it is acknowledged that this new reality increases insurance premiums, the key takeaway to those renewing the policy is that an appraisal can remove some uncertainty.

An appraisal will supply a current and supportable value, which will clarify the exposure amount. Also, a well-conducted appraisal can reduce uncertainty by including the collection of data insurers want to be included in their modeling. Catastrophic models work by scoring data elements such as construction type on a scale from low to high risk with unreported data fields receiving the highest risk scores. Even simple data elements such as how a roof is constructed, or the storm rating of windows installed can change a property rate if properly reported. Transparency helps to remove uncertainty.

Resort structures rarely fit into a single construction type or age throughout (e.g., an original wood-framed building vs. masonry addition), and different types and ages of construction receive varying risk scores. Recent construction would likely require enhanced protection from perils such as fire or wind damage which needs to be considered in an appraisal.

Consider asking prospective insurers what data is being used to calculate the rate and if there are any additional data elements they would like collected.

Increased Construction Costs and Timing

Whether your renewal values are based on a recent appraisal or trended from a previous one, increases in construction costs are an important factor in being properly insured in case of a loss.

One of the major drivers in construction costs is inflation’s effect on building materials, machinery and equipment, and labor. It is important to keep in mind that as benchmarks have been at or near record levels, inflation will boost the cost to recover from a property loss.

While the cost to restore or rebuild after a loss has always trended upwards, it has even outpaced inflation in recent years. Material and especially labor costs are regional factors the location of the assets being insured is important too. The old method of annually applying a flat percentage based on a single index such as a national consumer price index may cause you to be over or underinsured. Current and relevant construction values are essential.

Rising construction costs, inflation, and global climate change loom over the conversation. On one side of the bargaining table, hospitality and resort stakeholders seek affordable insurance coverage to protect against potential losses. On the other side sit insurance professionals dealing with hardening property insurance markets and increasing reinsurance rates. Like all negotiations, it’s best to prepare yourself with the facts before you sit down.

ABOUT WITHUM

Withum is a forward-thinking, technology-driven advisory and accounting firm, committed to helping clients in the hospitality industry be more profitable, efficient, and productive in the modern business landscape. For further information about Withum’s hospitality services, contact Lena Combs (LCombs@Withum.com) at (407) 849-1569, or visit www.withum.com/hospitality.