Bluegreen Vacations Reports Financial Results for Second Quarter 2023

Bluegreen Vacations Holding Corporation (NYSE: BVH) (OTCQX: BVHBB) (the “Company” or “Bluegreen”) reported today its financial results for the quarter ended June 30, 2023.

Key Highlights as of and for the Quarter Ended June 30, 2023:

- Net income attributable to shareholders increased 23% to $21.9 million from $17.8 million in the prior year quarter.

- Diluted Earnings Per Share (“EPS”) increased 54% to $1.34 from $0.87 in the prior year quarter.

- Total revenue increased 11% to $260.6 million from $235.6 million in the prior year quarter.

- System-wide sales of vacation ownership interests (“VOIs”) increased 1% to $200.7 million from $198.5 million in the prior year quarter.(1)

- Number of guest tours increased 1% to 66,916 from 66,376 in the prior year quarter.

- Vacation packages sold increased 17% to 47,114 compared to 40,395 in the prior year quarter.

- Vacation packages outstanding of 166,686 as of June 30, 2023, compared to 165,240 as of December 31, 2022 and 184,782 outstanding as of June 30, 2022.

- Adjusted EBITDA attributable to shareholders increased 17% to $40.7 million from $34.7 million in the prior year quarter. (2)

- In April 2023, Bluegreen/Big Cedar Vacations LLC, a joint venture between the Company and Bass Pro Shops, acquired Branson Cedars Resort, an 80-acre property adjacent to the joint venture’s Wilderness Club at Big Cedar Resort.

- In May 2023, Bluegreen acquired an existing property in Nashville, Tennessee, to be converted into a 15-story timeshare resort.

- In June 2023, Bluegreen completed a private offering and sale of approximately $214.6 million of VOI receivable-backed notes.

Related: Bluegreen Vacations Increases Inventory/Top Suites

Key Highlights as of and for the Six Months Ended June 30, 2023:

- Net income attributable to shareholders decreased 1% to $33.4 million from $33.8 million in the prior year period.

- Diluted Earnings Per Share (“EPS”) increased 26% to $2.05 from $1.63 in the prior year period.

- Total revenue increased 11% to $479.7 million from $430.6 million in the prior year period.

- System-wide sales of vacation ownership interests (“VOIs”) increased 5% to $367.7 million from $350.1 million in the prior year period.(1)

- Number of guest tours increased 3% to 118,671 from 115,237 in the prior year period.

- Vacation packages sold increased 7% to 87,894 compared to 82,385 in the prior year period.

- Adjusted EBITDA attributable to shareholders increased 8% to $70.8 million from $65.7 million in the prior year period.(2)

- Free cash flow was an outflow of $58.5 million in the six months ended June 30, 2023, compared to an inflow of $61.1 million for the six months ended June 30, 2022, primarily as a result of the acquisition and development of real estate, an increase in VOI notes receivable originations and timing of changes in working capital.(3)

| (1) | See appendix for reconciliation of system-wides sales of VOIs to gross sales of VOIs for each respective period. |

| (2) | See appendix for reconciliation of Adjusted EBITDA attributable to shareholders to net income attributable to shareholders for each respective period. |

| (3) | See appendix for reconciliation of free cash flow to net cash provided by operating activities. |

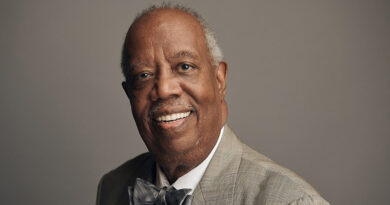

Alan B. Levan, Chairman and Chief Executive Officer of Bluegreen Vacations Holding Corporation, commented, “We continue to be excited by our overall performance, which drove a 17% increase in Adjusted EBITDA in the second quarter of 2023. We believe that the results in the second quarter reflect our dual focus on achieving growth while at the same time improving our profit margin. Not only did we achieve a second quarter record $200.7 million of system-wide sales, but we achieved this while also reducing our selling and marketing costs to 53% of system-wide sales in the second quarter of 2023 compared to 57% in the second quarter of 2022. Our focus on improving the efficiency of our vacation package marketing programs drove marketing costs down, while also producing a 17% increase in vacation package sales in the second quarter of 2023 compared to the second quarter of 2022. In addition, we realized lower sales commission expense as a percentage of system-wide sales during the 2023 quarter compared to the 2022 quarter.”

“Our system-wide sales were 1% higher in the second quarter of 2023 as compared to the second quarter of 2022. This increase reflected the impact of a 1% increase in guest tours over the prior year quarter, at a consistent sales volume per guest of approximately $3,013. Had it not been for the out of service units in certain Florida properties because of hurricanes in 2022, we believe we would have achieved greater efficiencies and sales of VOIs and we expect to continue to increase efficiency as more of these units are returned to our system in the coming months. We continue to improve our average sales price per transaction, which increased 4% to $21,456 during the 2023 quarter compared to the 2022 quarter.”

“Our sales of VOIs are driven by the success of our marketing programs, and Bluegreen’s marketing to new customers generally begins with the sale of a vacation package to a prospect. During the second quarter of 2023, we sold 47,114 vacation packages, a 17% increase from the 40,395 we sold in the second quarter of 2022. This increase was despite closing or going ‘virtual’ at 52 marketing locations on January 1, 2023. During the second quarter, we reopened four of these locations and are pleased with the early results.”

“We continue to see high demand for leisure travel and specifically for the Bluegreen Vacation Club, and we are pursuing a strategy to expand the offerings of vacation experiences for our owners in some of the most desirable locations in the country. In April 2023, Bluegreen/Big Cedar Vacations LLC, our joint venture with Bass Pro Shops, acquired the Branson Cedars Resort in Branson, Missouri, an 80-acre property with existing “tiny home” cottages, cabins, treehouses, and resort amenities, and with future development planned. In May 2023, we acquired a 15-story hotel in the historic Printers Alley district of Nashville, Tennessee. These acquisitions are the latest new properties added by Bluegreen in the last year, in addition to adding Presidential Suites and other units at certain of our existing resorts. While we expect that these expansion initiatives will in the future produce higher revenues and earnings, in the short-term the increased inventory carrying costs and start-up costs put pressure on our operating margin, as well as involve increased or higher acquisition and development expenditures which adversely impacted our free cash flow during 2023 to date.”

“Our strategy of increasing our note receivable portfolio from financed sales of VOIs is also contributing to Adjusted EBITDA. Net interest spread, which is the excess of interest income from VOI notes receivable over the interest expense from pledging and selling those VOI notes receivable in the capital markets, increased 11% to $21.5 million in the second quarter of 2023 from $19.3 million in the second quarter of 2022.”

“We were also pleased that our Adjusted EBITDA at Resort Management and Club Operations increased by 11% in the second quarter of 2023, to a record $23.1 million from $20.9 million in the second quarter of 2022. We believe that the results of this segment are important to our continued goal of generating recurring free cash flow and earnings.”

“We believe that, from a balance sheet perspective, we are well positioned to navigate uncertain economic conditions by virtue of our approximately $178.7 million of unrestricted cash on hand and $500.4 million of conditional availability under our lines of credit and receivable purchase facilities as of June 30, 2023. We also believe we have a level of protection from rising interest rates as 54% of our outstanding debt at June 30, 2023 bear interest rates that are currently fixed. We were pleased to complete a private offering and sale of $214.6 million of VOI receivable-backed notes in June 2023, which we believe evidences our continued ability to raise capital in the securitization markets. Our plan is to maintain what we believe to be a healthy balance sheet, while continuing our focus on growth and profitability over the long term.” Mr. Levan concluded.