Pioneer Bill Ryczek, RRP Founder Colebrook Financial Company

The Timeshare Pioneers series for Resort Trades was created to chronicle and honor the involvement of a handful of true pioneers whose early contributions and entrepreneurial spirit paved the way for today’s nearly $10 billion a year timeshare industry.

Not all pioneers in the timeshare industry were developers. The genuine heroes were behind-the-scenes finance companies who took major risks by providing consumer funding for buyers of the little known and less understood timeshare product.

With his entrepreneurial and pioneering spirit, Bill Ryczek, RRP, went were few had gone before to become one of the first financiers to specialize in timeshare lending.

After obtaining an MBA from Penn State University, Bill joined Barclays American Business Credit in 1979 to begin his banking career. Barclays was one of the first companies to make loans to the then new timeshare industry.

“When auditing timeshare developers between 1979-1981,” Bill recalls, “we literally found records in shoe boxes. We called them ‘commando audits’ and tried very quickly to find out whether the company was profitable, financeable, and honest … all from limited information. It was an exercise in forensic accounting before forensic accounting was popular. The emphasis then was almost solely on sales—the administrators were the people who couldn’t sell. If we wanted meaningful projections, we usually had to do them ourselves. In those days, the business was dominated by small, entrepreneurial companies that were heavy on sales and light on administration, and too frequently light on legal compliance. It was a great learning experience.”

During the 1980s, the biggest hypothecation (loans secured by portfolios) lenders were Barclays and Finova. Slowly, banks climbed on the timeshare bandwagon. The finance companies were generally good at underwriting developers and the banks were good at underwriting individual consumers. Several savings and loans entered the business but quickly failed or turned out to be fraudulent.

Bill was national marketing manager for the timeshare division when he left Barclays in 1988 to join Liberty Bank as Vice President and Timeshare Manager, inheriting a large portfolio of troubled loans. He became very active in working them out—in an un-banker manner–and adept at analyzing both the developer and consumer.

Looking back, he reminisces, “We tried to fix the problems, turn the resort around, and get as much of the bank’s money back as we could. Having an entrepreneurial attitude was ideal for workouts. There’s no better way to learn about underwriting than to try to fix a broken project. This helps you learn what can go wrong and try to guard against it the next time around.”

In today’s culture of obtaining instant personal credit ratings via the internet, it is important to understand that the few finance companies in the business in the early years of timesharing were slow to pick up on the importance of FICO scores and didn’t grasp the fact that even people with good credit weren’t likely to pay if the resort closed and the developer failed.

When Bill left Liberty in 2002, he was Chief Lending Officer, with responsibility for a $1.3 billion portfolio, consisting of residential mortgages, consumer loans, commercial mortgages and commercial loans, as well as the Bank’s $300 million timeshare portfolio. In January 2003, he launched Colebrook Financial Company–based in Middletown, Connecticut–and initially made loans to timeshare developers and purchased and originated receivable portfolios. Most customers were small, but as the years went on, many grew, and since they valued the relationship with Colebrook, remained customers. Today, Colebrook provides financing for the timeshare industry and offers loans in amounts ranging from $100,000 to $30 million or more.

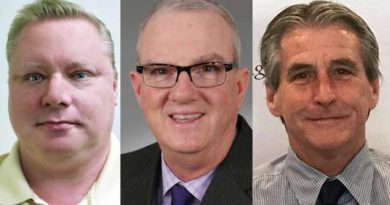

At Colebrook, Bill has primary responsibility for marketing and banking relations. After more than 35 years in the timeshare industry, he is well known and a frequent speaker at conventions on the topic of receivable financing. All of Colebrook’s active partners–Jim Bishop, Fred Dauch, Tom Petrisko, and Mark Raunikar– have extensive timeshare lending experience and share the same work ethic and commitment to customer service. Bill and his team have had a consistent presence in the timeshare industry since 1988 and have never stopped lending.

When the financial crisis hit at the end of 2008, Colebrook was in a position to take advantage of the void created by the exit of two of the timeshare industry’s largest lenders. Over the next two years, they established lending relationships with some of the leading timeshare developers in the United States and completed the transition from a small specialty company to one capable of competing with any industry lender with competitive rates and a personal service level far above large institutional lenders. Bill shares that “small lenders generally do small loans with big rates. Big lenders seldom want anything to do with small loans. We are perfectly poised to do both.”

Adds Bill, “We have an innovative approach to financing and pride ourselves on rapid turnaround and personal service. We have no committees, a client can always talk to a principal, and our most important policy is common sense. We were the first to combine underwriting the developer and consumer to ensure that the entire package works. Similar to timeshare sales, after we obtain a customer, we often upgrade and ‘reload’ them with other services. We try to connect our customers with other companies that may help them increase their business.”

As the timeshare industry matured and became a mainstream player in the hospitality industry, Bill says, “We were no longer a little oddball product and the influx of major lenders was a natural evolution.”

Another significant improvement has been the professionalism of management, particularly in the finance area. While this has made Bill’s job easier, it’s also made the finance people tougher negotiators, because they have a much better grasp of the facts.

Today, Colebrook is one of the nation’s most prominent lenders to homeowners’ associations. Because the timeshare industry is almost 40 years old, many resorts that were built in the 1970s and 1980s are now in need of extensive refurbishment and rehabilitation. Older resorts often have older owners, many of whom are on fixed incomes, meaning that a large one-time special assessment could be problematic. Experience has shown that often, the best solution is to borrow the funds and repay the loan with smaller special assessments over a period of time.

“Most association loan requests are too small to interest national timeshare lenders and too unusual and complex for the local bank,” explains Bill. “We have filled that void with a product that provides associations with a vehicle to finance much-needed improvements. With our extensive timeshare expertise, we can underwrite requests quickly and with relatively simple documentation and close loans with minimal legal expense.”

In looking ahead, Bill believes the industry will continue to thrive but the product will change to become more flexible with shorter terms. Many smaller developers and vacation clubs are already offering vacation packages with limited terms and considerable flexibility. Changing the product length will eliminate the need for a secondary market and go a long way toward emphasizing the positive aspects of timesharing.

For those in business for many years, Bill says that it is important to use the experience gained in the past to work on the problems of the present. “The challenge of being an old timer,” he says, “is not being stuck in the past.”