Travel + Leisure Co. Reports Third Quarter 2025 Results

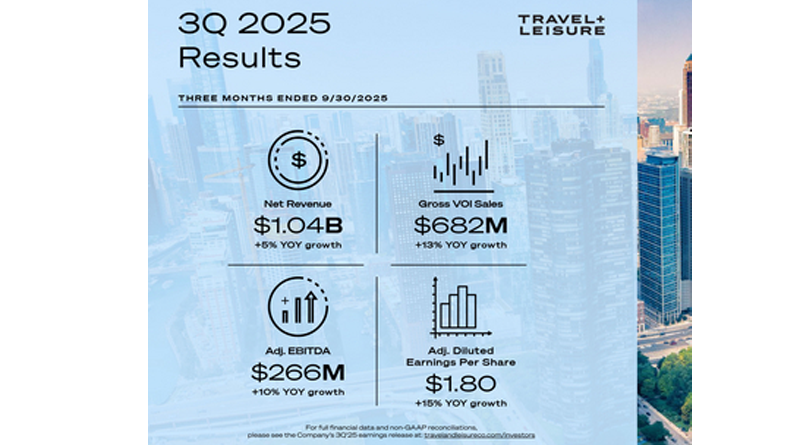

Travel + Leisure Co. (NYSE:TNL), a leading leisure travel company, today reported third quarter 2025 financial results for the three months ended September 30, 2025. Highlights and outlook include:

- Net income of $111 million, $1.67 diluted earnings per share, on net revenue of $1.04 billion

- Adjusted EBITDA of $266 million and Adjusted diluted earnings per share of $1.80 (1)

- Vacation Ownership revenue of $876 million, up 6 percent year-over-year

- Volume per guest (VPG) of $3,304, a 10 percent increase year-over-year

- Increasing mid-point of full year Adjusted EBITDA guidance to $975 million, with a new range of $965 million to $985 million

- Returned $106 million to shareholders through $36 million of dividends and $70 million of share repurchases

“Travel + Leisure Co. delivered another exceptional quarter, exceeding the high end of our Adjusted EBITDA guidance and achieving our 18th consecutive quarter with a VPG above $3,000. Thanks to the incredible work of our associates, we continue to execute on our strategy and drive long-term value for our shareholders,” said Michael D. Brown, President and CEO of Travel + Leisure Co.

“This quarter marked exciting progress in our multi-brand strategy with the launch of the Eddie Bauer Adventure Club and the announcement of a new Sports Illustrated Resort in Chicago. These partnerships expand our reach to new audiences, strengthen our brand portfolio, and reinforce our ability to deliver exceptional vacation experiences.”

| (1) This press release includes Adjusted EBITDA, Adjusted diluted EPS, Adjusted free cash flow, Gross VOI sales, Adjusted net income, Adjusted pre-tax income and Adjusted EBITDA margin, which are measures that are not calculated in accordance with Generally Accepted Accounting Principles in the U.S. (“GAAP”). See “Presentation of Financial Information” and the tables for the definitions and reconciliations of these non-GAAP measures. Forward-looking non-GAAP measures are presented in this press release only on a non-GAAP basis because not all of the information necessary for a quantitative reconciliation is available without unreasonable effort. |

Business Segment Results

Vacation Ownership

| $ in millions | Q3 2025 | Q3 2024 | % change |

| Revenue | $876 | $825 | 6 % |

| Adjusted EBITDA | $231 | $202 | 14 % |

Vacation Ownership revenue increased 6% to $876 million in the third quarter of 2025 compared to the same period in the prior year. Net vacation ownership interest (VOI) sales increased 9% year over year despite a higher provision rate. Gross VOI sales increased 13% driven by a 10% increase in VPG and a 2% increase in tours.

Third quarter Adjusted EBITDA was $231 million compared to $202 million in the prior year period driven by the revenue growth and lower cost of VOIs sold.

Travel and Membership

| $ in millions | Q3 2025 | Q3 2024 | % change |

| Revenue | $169 | $168 | 1 % |

| Adjusted EBITDA | $58 | $62 | (6) % |

Travel and Membership revenue increased 1% to $169 million in the third quarter of 2025 compared to the same period in the prior year. This was driven by a $3 million increase in transaction revenue due to a 12% increase in transactions, partially offset by an 8% decrease in revenue per transaction.

Third quarter Adjusted EBITDA decreased 6% to $58 million compared to the same prior year period. This decrease was driven by a higher mix of travel club transactions, which generate lower margins.

Balance Sheet and Liquidity

Net Debt — As of September 30, 2025, the Company’s leverage ratio for covenant purposes was 3.3x. The Company had $3.6 billion of corporate debt outstanding as of September 30, 2025, which excluded $2.0 billion of non-recourse debt related to its securitized notes receivables portfolio.

Secured Notes Refinancing — During the third quarter, we issued secured notes, with a face value of $500 million and an interest rate of 6.125%. The proceeds were used to redeem all of our $350 million 6.60% secured notes due October 2025, toward repayment of outstanding borrowings under the revolving credit facility, to pay fees and expenses incurred with the issuance and for other general corporate purposes.

Timeshare Receivables Financing — The Company closed on a $300 million term securitization transaction on July 22, 2025 with a weighted average coupon of 5.10% and a 98.0% advance rate.

Subsequent to the end of the quarter, the Company closed on a $300 million term securitization transaction with a weighted average coupon of 4.78% and a 98% advance rate.

Cash Flow— For the nine months ended September 30, 2025, net cash provided by operating activities was $516 million compared to $366 million in the prior year period. Adjusted free cash flow was $326 million for the nine months ended September 30, 2025 compared to $266 million in the same period of 2024 due to a decrease in cash utilization for working capital items, partially offset by higher net payments on non-recourse debt.

Share Repurchases — During the third quarter of 2025, the Company repurchased 1.2 million shares of common stock for $70 million at a weighted average price of $59.90 per share. As of September 30, 2025, the Company had $253 million remaining in its share repurchase authorization, which includes $20 million of proceeds received from stock option exercises during the third quarter of 2025, which increase the repurchase capacity of our share repurchase authorization.

Dividend— The Company paid $36 million ($0.56 per share) in cash dividends on September 30, 2025 to shareholders of record as of September 12, 2025. Management will recommend a fourth quarter dividend of$0.56per share for approval by the Company’s Board of Directors in November 2025.

Outlook

The Company is updating guidance for the 2025 full year:

- Adjusted EBITDA of $965 million to $985 million (vs. prior outlook of $955 million to $985 million)

- Gross VOI sales of $2.45 billion to $2.50 billion (vs. prior outlook of $2.4 billion to $2.5 billion)

- VPG of $3,250 to $3,275 (vs. prior outlook of $3,200 to $3,250)

This guidance is presented only on a non-GAAP basis because not all of the information necessary for a quantitative reconciliation of forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measure is available without unreasonable effort, primarily due to uncertainties relating to the occurrence or amount of these adjustments that may arise in the future. Where one or more of the currently unavailable items is applicable, some items could be material, individually or in the aggregate, to GAAP reported results.

Conference Call Information

Travel + Leisure Co. will hold a conference call with investors to discuss the Company’s results and outlook today at 8:00 a.m. ET. Participants may listen to a simultaneous webcast of the conference call, which may be accessed through the Company’s website at travelandleisureco.com/investors, or by dialing 877-733-4794 ten minutes before the scheduled start time. For those unable to listen to the live broadcast, an archive of the webcast will be available on the Company’s website for 90 days beginning at 12:00 p.m. ET today.

Presentation of Financial Information

Financial information discussed in this press release includes non-GAAP measures such as Adjusted EBITDA, Adjusted diluted EPS, Adjusted free cash flow, gross VOI sales, Adjusted net income, Adjusted pre-tax income and Adjusted EBITDA margin, which include or exclude certain items, as well as non-GAAP guidance. The Company utilizes non-GAAP measures, defined in Table 7, on a regular basis to assess performance of its reportable segments and allocate resources. These non-GAAP measures differ from reported GAAP results and are intended to illustrate what management believes are relevant period-over-period comparisons and are helpful to investors when considered with GAAP measures as an additional tool for further understanding and assessing the Company’s ongoing operating performance by adjusting for items which in our view do not necessarily reflect ongoing performance. Management also internally uses these measures to assess our operating performance, both absolutely and in comparison to other companies, and in evaluating or making selected compensation decisions. Exclusion of items in the Company’s non-GAAP presentation should not be considered an inference that these items are unusual, infrequent or non-recurring. Full reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures for the reported periods appear in the financial tables section of the press release.

The Company may use its website as a means of disclosing information concerning its operations, results and prospects, including information which may constitute material nonpublic information, and for complying with its disclosure obligations under SEC Regulation FD. Disclosure of such information will be included on the Company’s website in the Investor Relations section at travelandleisureco.com/investors. Accordingly, investors should monitor that Investor Relations section of the Company website, in addition to accessing its press releases, its submissions and filings with the SEC, and its publicly noticed conference calls and webcasts.

About Travel + Leisure Co.

Travel + Leisure Co. (NYSE:TNL) is a leading leisure travel company, providing more than six million vacations to travelers around the world every year. The Company operates a portfolio of vacation ownership, travel club, and lifestyle travel brands designed to meet the needs of the modern leisure traveler, whether they’re traversing the globe or staying a little closer to home. With hospitality and responsible tourism at its heart, the company’s nearly 19,000 dedicated associates around the globe help the Company achieve its mission to put the world on vacation. Learn more at travelandleisureco.com.

Forward-Looking Statements

This press release includes “forward-looking statements” as that term is defined by the Securities and Exchange Commission (“SEC”). Forward-looking statements are any statements other than statements of historical fact, including statements regarding our expectations, beliefs, hopes, intentions or strategies regarding the future. In some cases, forward-looking statements can be identified by the use of words such as “may,” “will,” “expects,” “should,” “believes,” “plans,” “anticipates,” “intends,” “estimates,” “predicts,” “potential,” “projects,” “continue,” “future,” “outlook,” “guidance,” “commitments,” or other words of similar meaning. Forward-looking statements are subject to risks and uncertainties that could cause actual results of Travel + Leisure Co. and its subsidiaries (“Travel + Leisure Co.” or “we”) to differ materially from those discussed in, or implied by, the forward-looking statements. Factors that might cause such a difference include, but are not limited to, risks associated with: the acquisition of the Travel + Leisure brand and the future prospects and plans for Travel + Leisure Co., including our ability to execute our strategies to grow our cornerstone timeshare and exchange businesses and expand into the broader leisure travel industry through our travel clubs; our ability to compete in the highly competitive timeshare and leisure travel industries; uncertainties related to acquisitions, dispositions and other strategic transactions; the health of the travel industry and declines or disruptions caused by adverse economic conditions (including inflation, recent tariff and other trade restrictions, higher interest rates, recessionary pressures, and any potential adverse economic impacts resulting from the U.S. federal government shutdown), travel restrictions, terrorism or acts of gun violence, political strife, war (including hostilities in Ukraine and the Middle East), pandemics, and severe weather events and other natural disasters; adverse changes in consumer travel and vacation patterns, consumer preferences and demand for our products; increased or unanticipated operating costs and other inherent business risks; our ability to comply with financial and restrictive covenants under our indebtedness; our ability to access capital and insurance markets on reasonable terms, at a reasonable cost or at all; maintaining the integrity of internal or customer data and protecting our systems from cyber-attacks; the timing and amount of future dividends and share repurchases, if any; and those other factors disclosed as risks under “Risk Factors” in documents we have filed with the SEC, including in Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2024, filed with the SEC on February 19, 2025. We caution readers that any such statements are based on currently available operational, financial and competitive information, and they should not place undue reliance on these forward-looking statements, which reflect management’s opinion only as of the date on which they were made. Except as required by law, we undertake no obligation to review or update these forward-looking statements to reflect events or circumstances as they occur.